In the dynamic world of business, acquisitions have become a prevalent strategy for organizations aiming to expand their market share, diversify their product portfolios, gain access to new capabilities and technologies, or broaden their customer base.

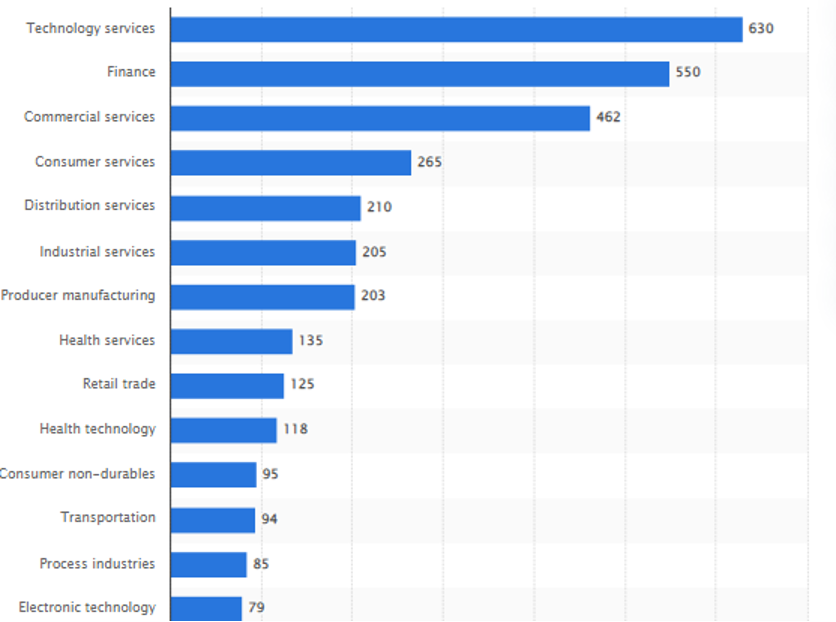

In Q2 of 2023, there were over 630 M&A deals in the US technology sector alone. Following soon after was the Finance sector with 550 mergers and commercial services, experiencing 462 mergers.

While the advantages of acquisitions are clear, the integration of these newly acquired entities can pose significant challenges, requiring meticulous planning and execution by leaders. This article looks into the complexities involved in merger and acquisition (M&A) strategies, integration challenges, and post-merger best practices.

Integration: A Holistic Approach

Acquiring a new entity is a multifaceted endeavor, involving the melding of two organizations that may operate differently in terms of operations, culture, technology, and more. Successful integration necessitates a strategic approach that addresses both the operational and cultural aspects of the process.

In this article, we explore some of the key challenges that organizations face during the integration of acquisitions and outline strategies to overcome them. These challenges encompass a wide spectrum of areas, including

- Leadership,

- Communication,

- Staff retention,

- Resource allocation,

- Cultural alignment,

- Sales and marketing integration,

- Operational streamlining,

- Property and facility consolidation,

- IT system integration,

- Financial harmonization,

- Legal and regulatory compliance,

- Goodwill consolidation,

- Supplier and procurement unification,

- Resistance to change,

- Effective timing, and

- Comprehensive planning.

CEOs and CFOs stand as critical pillars for M&A deals, ensuring transparency and maintaining the best interest of both parties involved.

Leadership During M&A Deals

An essential factor in the success of acquisition integration is effective leadership styles. However, merging effective leadership teams from two different organizations can be a complex task, especially when disparities in leadership styles, priorities, and visions exist.

To address this challenge, it is crucial to identify and leverage the strengths of leadership teams from both companies. This may entail the formation of cross-functional teams for specific integration initiatives, accompanied by leadership training and coaching to ensure a shared vision and leadership approach.

Furthermore, establishing the leadership team of the combined business as early as possible streamlines other integration activities. Leadership alignment and drive are central to integration success. Mergers can be particularly problematic for the organization’s staff, hence leading to issues trying to retain top talent.

Communication During Mergers

Effective communication is pivotal to the success of any acquisition integration. However, when multiple stakeholders are involved, such as employees, unions, customers, suppliers, and shareholders, the complexity of communication escalates.

To tackle this challenge, establishing clear communication channels and protocols from the beginning is vital. Transparent communication plans targeting all stakeholder groups, such as regular email updates, town hall meetings, and one-on-one sessions with employees, help dispel uncertainty and anxiety, reducing the risk of harmful rumors and misinformation.

Building and managing a dedicated communications team can also manage customer, employee, or supplier concerns and questions effectively.

Retention of Key Staff

In the wake of an acquisition, uncertainty about job security can provoke high staff turnover, as mentioned above. This is particularly true for key employees. As a result, it can potentially affect the integration’s success.

To mitigate this, it is essential to focus on retaining and motivating key employees. Clear communication about the benefits of the merger or acquisition, career development opportunities, and retention bonuses for critical employees, even if their tenure may ultimately end post-integration, can significantly impact integration success.

Resource Management: Capacity & Capabilities

Beyond these challenges, resource availability, skills, and capabilities pose another hurdle when integrating acquisitions. Companies might encounter a shortage of skilled resources or a disparity in capabilities, potentially jeopardizing the integration process.

To address this, organizations must conduct a comprehensive capacity, skills, and capabilities assessment, identifying gaps and developing plans to fill them or provide necessary training. Key personnel from both companies should actively participate in the integration process to ensure the presence of required skills and capabilities.

Investment in M&A playbooks and employee development strengthens the team’s ability to tackle integration challenges.

Cultural Integration

One of the most critical aspects of acquisition integration is aligning the cultural values of the two organizations. Cultural differences can lead to friction, affecting trust, fostering resistance to change, and hindering effective communication. These differences can be exacerbated when organizations come from different geographies or possess distinct corporate cultures.

Both CEOs – especially the one who will handle the reigns after the merger – must understand the company culture to ensure there are no issues in the future. To overcome this challenge, an early integration process that involves key stakeholders from both organizations is essential.

This allows for a proactive and collaborative approach to identify and address cultural similarities and differences while fostering open communication channels. This may involve employee training on effective collaboration in the new cultural context. Importantly, cultural change should not be imposed; it is most effective when leaders exemplify these expectations.

Sales & Marketing Integration

Efficient integration of sales and marketing teams plays a pivotal role in achieving revenue synergies following acquisitions. Differences in sales and marketing strategies, tools, and processes between the acquiring and acquired companies can lead to inefficiencies and missed opportunities.

Developing a clear and unified sales and marketing strategy that capitalizes on both companies’ strengths is essential. Aligning sales and marketing teams, processes, and systems ensures a consistent customer experience.

Technology solutions, such as customer relationship management (CRM) and marketing automation platforms, can provide valuable insights into customer behavior, facilitating better-targeted sales and marketing efforts. By prioritizing sales and marketing integration early, companies can expedite the realization of revenue synergies.

Operational Integration

Operational aspects present another complex challenge during acquisition integration. This encompasses various components, including IT systems, supply chain management, property and facility management, and customer service.

CEOs must conduct thorough assessments of the operational systems and processes of both companies, which should ideally begin during the operational due diligence phase. Identifying areas of overlap, potential efficiencies, and complexities guides a well-informed integration plan.

Integrating property footprint, which includes offices, distribution centers, and manufacturing facilities, is another vital aspect of operational integration. Different real estate portfolios, lease agreements, and insurance contracts can impact costs and operations.

To address this challenge, organizations must conduct a comprehensive assessment of their property footprint and lease agreements. Identifying redundancies or inefficiencies and developing a plan for property consolidation, such as office spaces and distribution centers, is crucial. This necessitates careful coordination to minimize disruptions to business operations.

Integration of IT Systems

Integrating IT systems is one of the most intricate aspects of acquisition integration. When companies operate different systems or have incompatible systems, this challenge intensifies. A strategic approach to IT integration is indispensable, involving a comprehensive assessment of existing IT systems, identification of redundancies, and a detailed plan for integration.

Collaboration between IT teams from both companies ensures a smooth transition. Establishing a clear IT roadmap, aligning with the target operating model, expedites value delivery. For instance, the CEO-CTO collaboration is key here for success.

Financial Integration

Financial integration poses a substantial challenge during acquisition integration, covering areas such as aligning accounting systems, managing cash flows, and debt. A clear and comprehensive financial integration plan is paramount.

This plan should encompass accounting systems, financial reporting, cash management, and debt management. Active involvement of financial experts from both companies ensures a seamless transition. For example, one organization may be using GAAP principles, while the other may go for an IFRS accounting system.

This is often where legal and regulatory compliance issues come to light. Other critical aspects where compliance becomes an issue include:

- Employment law,

- Environmental regulations,

- Antitrust(s), and

- Competition compliance.

Understanding the legal and regulatory landscape in the regions of operation is essential. Conducting a thorough compliance assessment and developing a plan to address potential risks or issues is critical. Involving legal and regulatory experts in the integration process guarantees compliance with all applicable laws and regulations.

Learn more in CFO and Controller Roles in Mergers and Acquisitions: Key Considerations for Successful Integration.

Timing

Timing is a significant challenge during acquisition integration. The process can be time-consuming and complex, impacting the timing of essential business decisions and initiatives. Organizations should establish a clear timeline with milestones for the integration process.

This timeline should be realistic and encompass all aspects of integration, including cultural alignment, IT integration, and financial harmonization. Flexibility and adaptability are essential as unexpected challenges and delays can arise. If needed, a new board may be established for specifically for change and time management.

CEOs Need to Manage M&A Challenges

The integration of acquisitions presents complex and challenging obstacles, but with the right approach, it can be a transformative opportunity for organizations seeking to expand and diversify. By proactively addressing key challenges successful acquirers can navigate the intricacies of acquisition integration and achieve a favorable outcome.

These challenges may range from leadership issues and conflicts to communication, cultural alignment, operational efficiency, resistance to change, or timing of the change, By managing these challenges, CEOs must reinforce their capabilities and platforms for future growth, solidifying their positions as an industry leader in the ever-evolving world of business.

0 Comments